Chapter 2: Indicator Filters

Trend-based Filters:

TrendCe: For momentum-based entry signals, color-coded as bullish or bearish transitions.

Bollinger: Showing sustained price movement near the upper or lower band, indicating strong directional momentum.

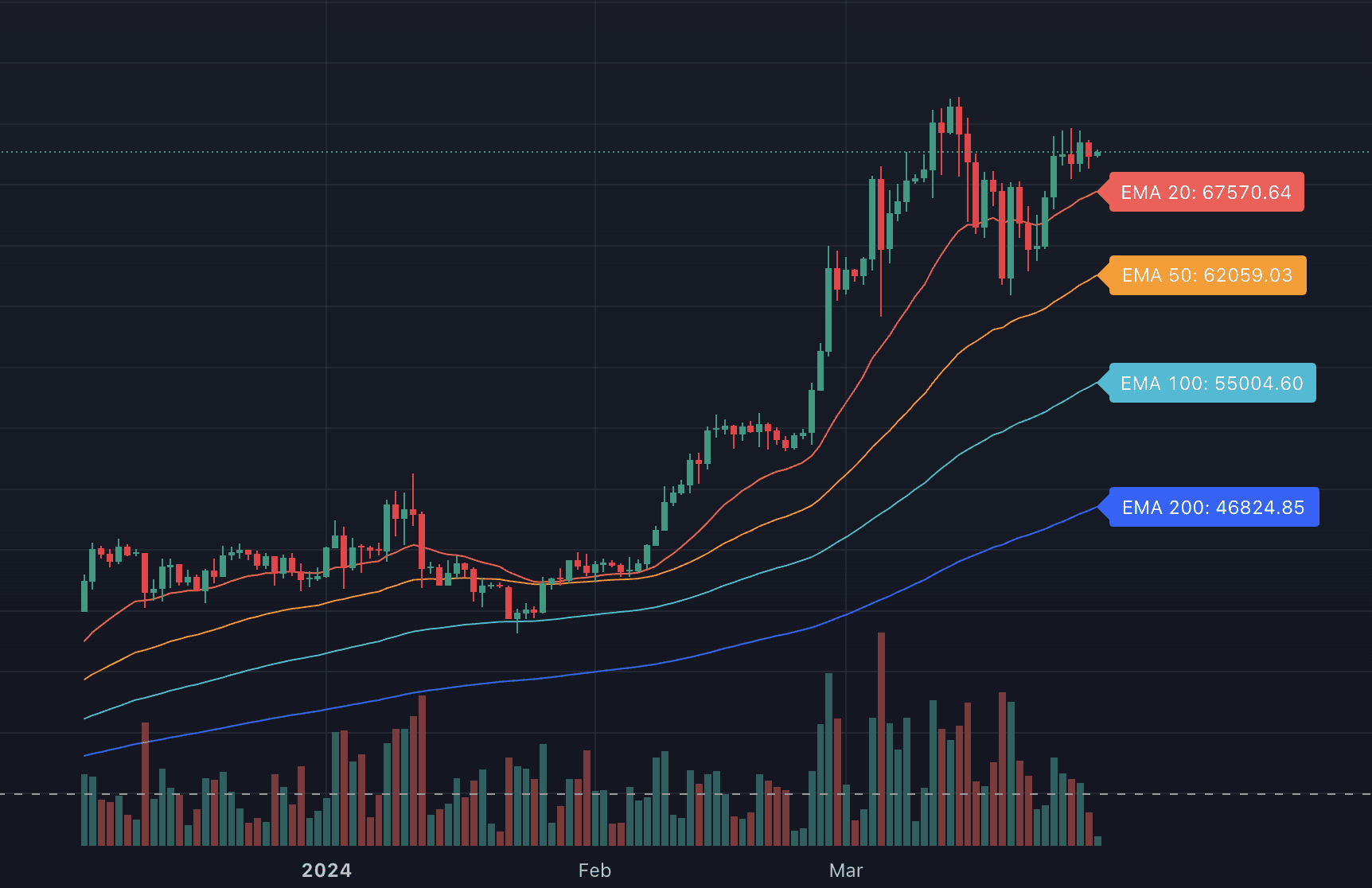

Trend Confirmation: When a shorter-term Exponential Moving Average (EMA) line crosses above or below a longer-term EMA line on a chart, generating a trading signal indicating a potential trend change.

SuperTrend: Identify market trends and generate buy and sell signals based on the Average True Range (ATR) indicator that measures market volatility.

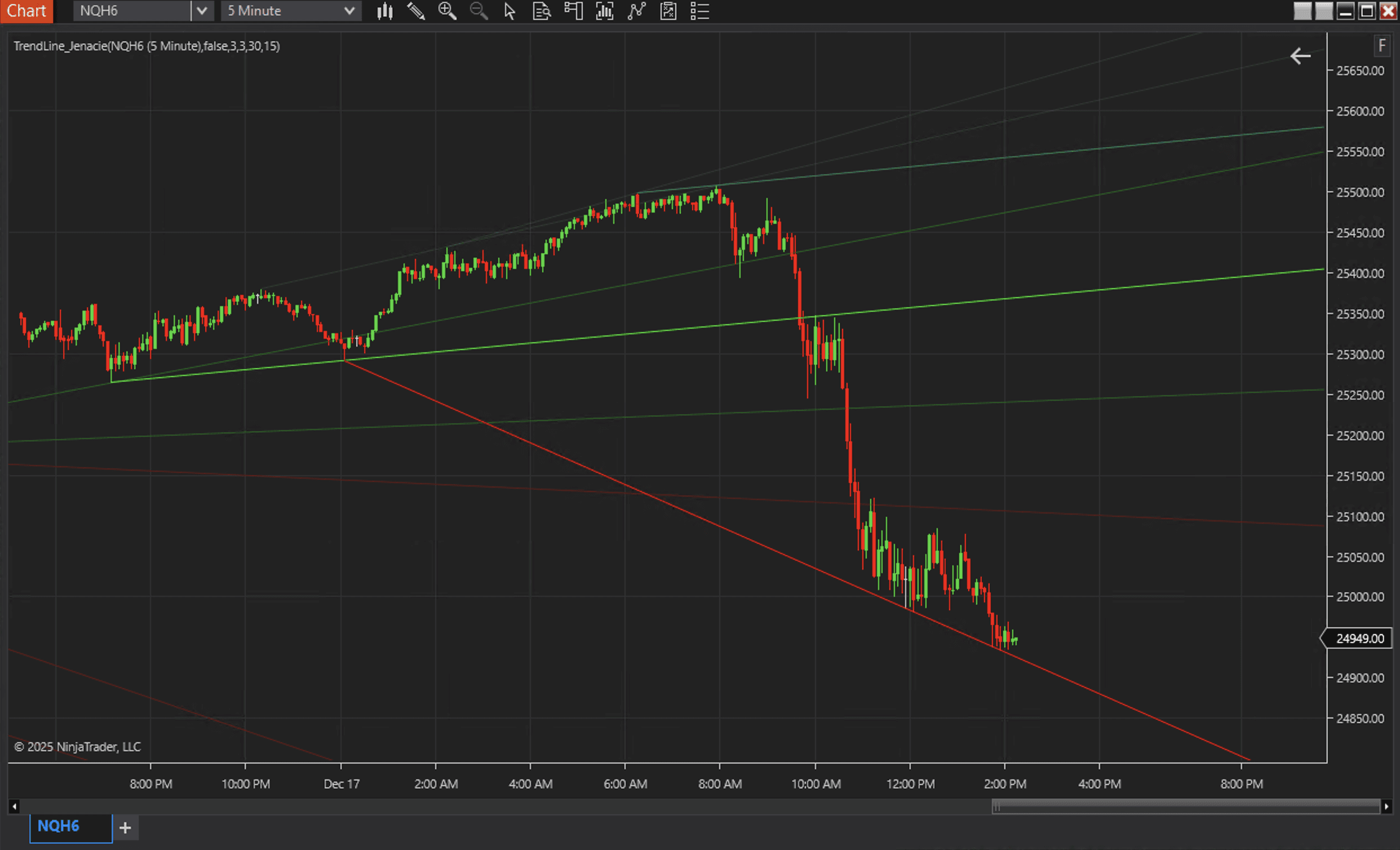

Trend Lines: Tracks dynamic trendlines and can enforce breakout/fade conditions.

Pattern-based Filters:

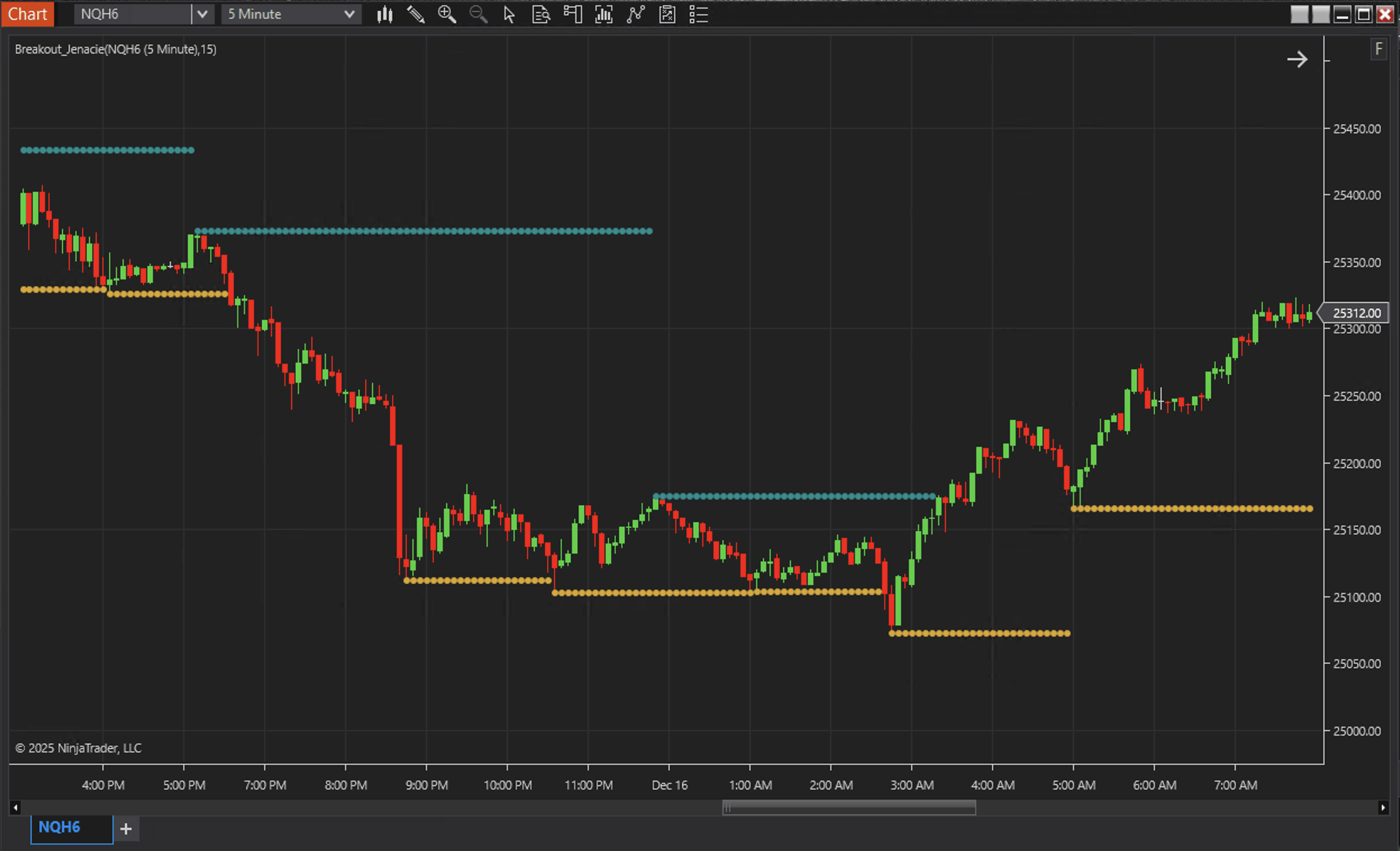

Swing Breakout: Uses recent swing highs/lows to filter potential breakout entries.

Candlestick Filters: Uses specific candlestick formations for trade confirmation or rejection.

Average Directional Index(ADX): Filters out trades during markets with low volatility.

Volatility: Rejects if the market volatility is below a certain threshold.

OrderFlow: Analyzes volumetric bars for buying vs. selling volume imbalance.

VWAP: Measures the ratio of an asset’s price to its total trade volume.

RSI: Enter and exit trades when the Relative Strength Index confirms a reversal from overbought or oversold conditions.

Time-based Filters

Multiple Trading Windows: Up to three daily windows specified as “Start HH:mm” and “End HH: mm.”

Skip Time Filters: Up to two intraday blocks for skipping trades.

Day-of-Week: Allows or disallows trading on Monday–Sunday individually.

Multi-Timeframe: Trend filters can be applied to a higher or a custom timeframe. While users trade at a different time frame.

News Filter: Turn on to avoid trading x min before and after high-impact news.